Since the beginning of this year, the natural rubber index of the Shanghai Futures Exchange has increased by over 38%, closing at 19,630 points on September 30, marking a new five-year high for the natural rubber index. Alongside the futures prices hitting new highs, spot prices of natural rubber have also reached a five-year peak. According to iFinD data, the domestic spot price of natural rubber was 17,942 yuan per tonne on September 30, a new five-year high.

Industry insiders have stated that the significant rise in natural rubber prices this year is mainly influenced by a combination of factors, including weather, policy initiatives, and market demand.

Firstly, from the supply side, the rise in rubber prices this year is mainly attributed to abnormal weather conditions. From the end of last year to the first half of this year, the El Niño phenomenon led to unusual weather, with major natural rubber producing regions experiencing drought and high temperatures in the first half, followed by frequent rainfall. In particular, in China, the tapping period in the first half was delayed, and continuous rainfall further affected the tapping process.

Therefore, there is a widespread expectation of a reduction in rubber raw material production, which has become the main factor driving price increases. Although there are short-term speculative factors in the market, overall, weather conditions are the primary factor affecting prices.

Additionally, domestic tire manufacturers maintained high operating rates in the first half, especially with an increased demand for semi-steel radial tires, which also boosted the demand for rubber.

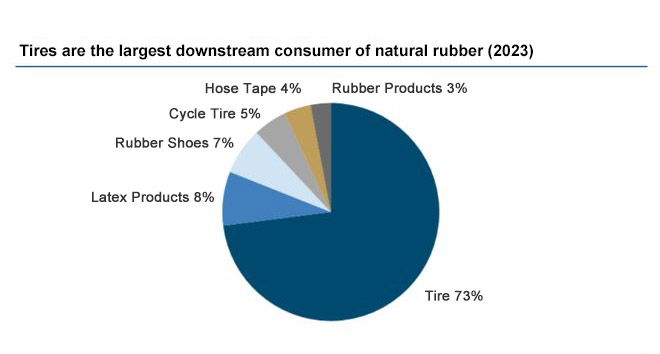

Data shows that natural rubber is an elastic solid obtained through coagulation, drying, and processing of latex secreted by rubber trees. Natural rubber is primarily used for tire production. Statistics indicate that tire consumption accounted for 73% of total natural rubber demand in 2023, while latex products, rubber shoes, and cycle tires accounted for 8%, 7%, and 5% respectively.

Secondly, another important factor contributing to the rise in rubber prices is the European Union's Zero-Deforestation Regulation (EUDR) announced last year. The regulation requires full traceability of related products and will be enforced by the end of 2024. Although the policy has an 18-month transitional period, many European tire manufacturers have already started implementing it. The regulation has increased the cost of natural rubber products. The certification and measurement costs associated with the EUDR have led to higher premiums for rubber raw materials that meet EUDR standards, which also contributed to the rise in natural rubber prices in the first half of the year.

The increase in natural rubber prices is also impacting downstream tire manufacturers. Multiple tire manufacturers have stated that the rise in rubber prices will lead to an increase in raw material costs for tires, thereby exerting pressure on the tire industry as a whole.

It is reported that tire manufacturers mainly cope with the risk of rising rubber prices by signing long-term agreement prices and increasing tire prices. This can lock in rubber prices for a certain period (usually one year), and when rubber prices rise short-term, the company's procurement costs for this part are not affected in the short term. However, if the long-term agreed price expires, it will be necessary to renegotiate the rubber procurement price based on market conditions. Secondly, companies can increase tire prices to address the risk of rising rubber prices, with products that can be price-increased in the short term mainly concentrated in the retail sector.

Generally, tire companies tend to increase prices later than the pace of rubber price increases, and the magnitude of price increases will also be smaller than the magnitude of rubber price increases. However, if rubber prices fall, tire companies will also adjust their product prices later than rubber prices, and the magnitude of price decreases will also be smaller than the decrease in rubber prices.